New Insight on Working capital Management

Strategic working capital management is different than it was only five years ago. While some companies view it as basic blocking and tackling, others embrace best practices and leverage technology to make the most of this fundamental business responsibility.Working capital management focuses on four

primary objectives:

1.

Optimizing

cash: Ensuring cash is

deployed efficiently by lean and automated processes

2.

Maximizing

cash: Maximizing cash

by shortening day sales outstanding (DSO) and extending days payable

outstanding (DPO) to meet or exceed benchmarks

3.

Visibility

and access to cash: Gaining

visibility and access to cash through optimal liquidity structure and

forecasting

4.

Protecting

cash: Preserving cash

by ensuring risk management policies and processes are in place

Taking a holistic approach

Effective working capital management employs a

comprehensive methodology, starting with these fundamentals:

·

Policies: Ensure corporate-wide policies are

written, communicated and audited

·

Technology: Leverage your ERP system and bank

technology to attain best-in-class levels of automation

·

Organization: Centralize functions such as credit,

order entry, cash application, procurement and payment execution to a corporate

level or shared service

·

Process: Ensure streamlined, automated processes

are in place, with tight controls to mitigate the risk of fraud and reduce the

risk of errors

Order-to-cash cycle

For each phase in the order-to-cash cycle, there are steps that can be taken to gain efficiencies, mitigate risk and identify problems. Following are some highlights:

Customer master

Centralized credit and collections, with standardized policies

and procedures that are audited. Don’t offer early payment discounts, but take

them from vendors if they are offered. Automate credit review and credit limit

decisions based on rules established in ERP system.

Order management

Don’t use sales people to put in orders, as it may not be the

best use of their time. Centralize order entry to surface problems and measure

order-entry accuracy to uncover potential problems due to manual entry.

Shipping and fulfillment

Use your ERP system to automate as much as possible, including

freight costs. For intercompany buying and selling, ensure transfer pricing methodology

is reviewed annually and takes into consideration where cash may be

accumulating

Invoice creation

Automate the creation of an invoice upon shipment of goods. Take

a lot of paper out of process by making the investment in electronic digital

invoicing (EDI).

Collections

Centralized collections group, with global policy and procedures

that are audited periodically. Focus on managing exceptions, rather than the

entire process. Look at the corporate trade exchange (CTX) to go from checks to

electronic collections. Nuisance check collections should be managed by remote

deposit for quickest access and availability of the cash,

Cash applications — Reconciliation/Reporting

Allow for straight-through processing based on electronic

invoicing, collecting, application and reconciliation. If you have disputes, do

a root-cause analysis. If you can automate high-volume, low-income expense, do

so. Leverage the company website to allow customers to view order status,

outstanding invoices and make payments.

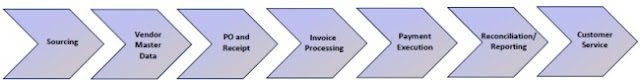

Procure-to-pay cycle

Vender master data

Centralize the vendor master: Get information from vendors on

banks and how, where they want to get paid. Protect this data by limiting

access and the ability to make changes. Banks often offer systems where they

hold all of that information.

RFP/contract negotiation

Centralized procurement-negotiated global contracts to capture

volume pricing, better terms and early pay discounts. Question how many vendors

in each category you really need to have. Tie payment terms to payment type to

encourage electronic payments over checks.

Requisition creation

Purchase orders should be created and delivered electronically

to vendors. Due date should auto-populate based on match of what was ordered,

what was received and what was invoiced.

Invoice processing

Automated three-way matching is functionality that most ERP

systems offer. Fully automated, best-in-class firms can process invoices within

three days.

Payment execution

With the growth in ACH and card usage, remove all checks and

paper-based transmissions and offer electronic payment and electronic

remittance information. Outsource any check printing to reduce costs and

protect against fraud. Leverage early pay discount; use ERP to measure terms

and see how often you take advantage of the discounts.

Reconciliation

Manage the exceptions. Track how long it takes to close the

books (what is causing any delays; will automation lead to faster accounting

close and reduce costs).

Fraud prevention for checks and online payment

When it comes to protecting a company’s cash,

it should be remembered that 60 percent of organizations are exposed to actual

or attempted payment fraud every year. A typical loss incurred due to payment

fraud is about $23,000.

If payments are made by check, accounts should

be reconciled on a daily basis. Internal duties for financial activities should

be segregated. In general, personnel should be fraud-focused on inquiries from

banks and institutions regarding legitimacy of checks. Suspicious activities

should be elevated to the management team. For added security, management may

want to consider migration from check payments to electronic payment products

or consider outsourcing check processing to secured vendor.

If hackers and fraudsters gain access to a

company’s computer system, they can harvest access credentials; internal

systems, financial systems, email; collect information on business contacts;

and initiate email to accounts payable and ask the recipient to process a

payment to pay a falsified invoice.

To prevent online fraud, all company users

should learn to recognize phishing scams and know to not open file attachments

or click links in suspicious emails. Anti-virus software and system patches

should be kept up to date. Users should be cautious when visiting Internet

sites that are not trusted and used for business purposes. User names and

passwords should never be shared and companies should avoid using automatic

log-in features that save them.

Transforming the treasury and finance

functions

By following these best practices, the

treasury and finance functions can be transformed from transactional processors

making payments and moving cash to advisors on risk and investments to

forward-looking strategists.

The opportunities for strategic working

capital management can be found throughout an organization. Incorporating lean

finance concepts can lower costs. Reviewing policies and ensuring tight

controls are in place can prevent fraud. Building better, automated processes

rather than replicating old processes can result in greater efficiency.

Capturing cost synergies between companies can allow a merger or acquisition to

realize value sooner than it might have otherwise.

Overall, the best practices of working capital

management revolve around four basic trends:

·

Centralization: Invoice processing, procurement, credit,

collections and cash applications

·

Standardization: One policy, process and technology

across all groups and subgroups

·

Automation: Remove manual steps, focus on technology

enablement

·

“Electronification”: Remove paper-based transmissions, focus

on host-to-host EDI

Properly implemented and maintained, the

efficiencies gained through effective working capital management can lead to

cost savings for the organization. It can also result in better data

management, which will provide company executives with more accurate and timely

reporting for better-informed decision-making. With fewer errors and tighter

controls, a comprehensive approach can help lower the rate of errors and

mitigate the risk of fraud.

By: Akinola Taofeek

Freelancer/ Consultant

+233(0) 243321202

Akinola77@gmail.com

By: Akinola Taofeek

Freelancer/ Consultant

+233(0) 243321202

Akinola77@gmail.com

very innovative ideas

ReplyDeletenice one

ReplyDeletekeep it up

ReplyDeletevery practical for newly start up business

ReplyDeletegood one

ReplyDeletevery attractive to learn

ReplyDeletei can not wait to apply to my newly start business

ReplyDeletekeep it up bro

ReplyDeleteinteretsing

ReplyDeleteexcellent

ReplyDeletegood

ReplyDeleteworking capital management

ReplyDeleteexcellent job done for business

ReplyDeletemowking capital info, nice one

ReplyDeletemore is expected

ReplyDeletewe need practical side of these

ReplyDeletenice one bro

ReplyDeleteworking capital policy for start up business to learn from

ReplyDeletegood ones bro

ReplyDeleteThese days it is hard to get home loans. Either its home equity loan or its mortgage loan and availability of easy home equity loans is in full bloom. These loans are uncomplicated, tenable, easily available, very flexible and tailor-made for homeowners. The best part about all this is that almost every loan lending or financial institution offers loans at high rate but Mr Pedro offers low loan rate @ 2% rate in return of such Business loan,Personal Loan, Home Loan, Car Loan.

ReplyDeleteYou can contact Mr Pedro on pedroloanss@gmail.com